Menu

Navigation

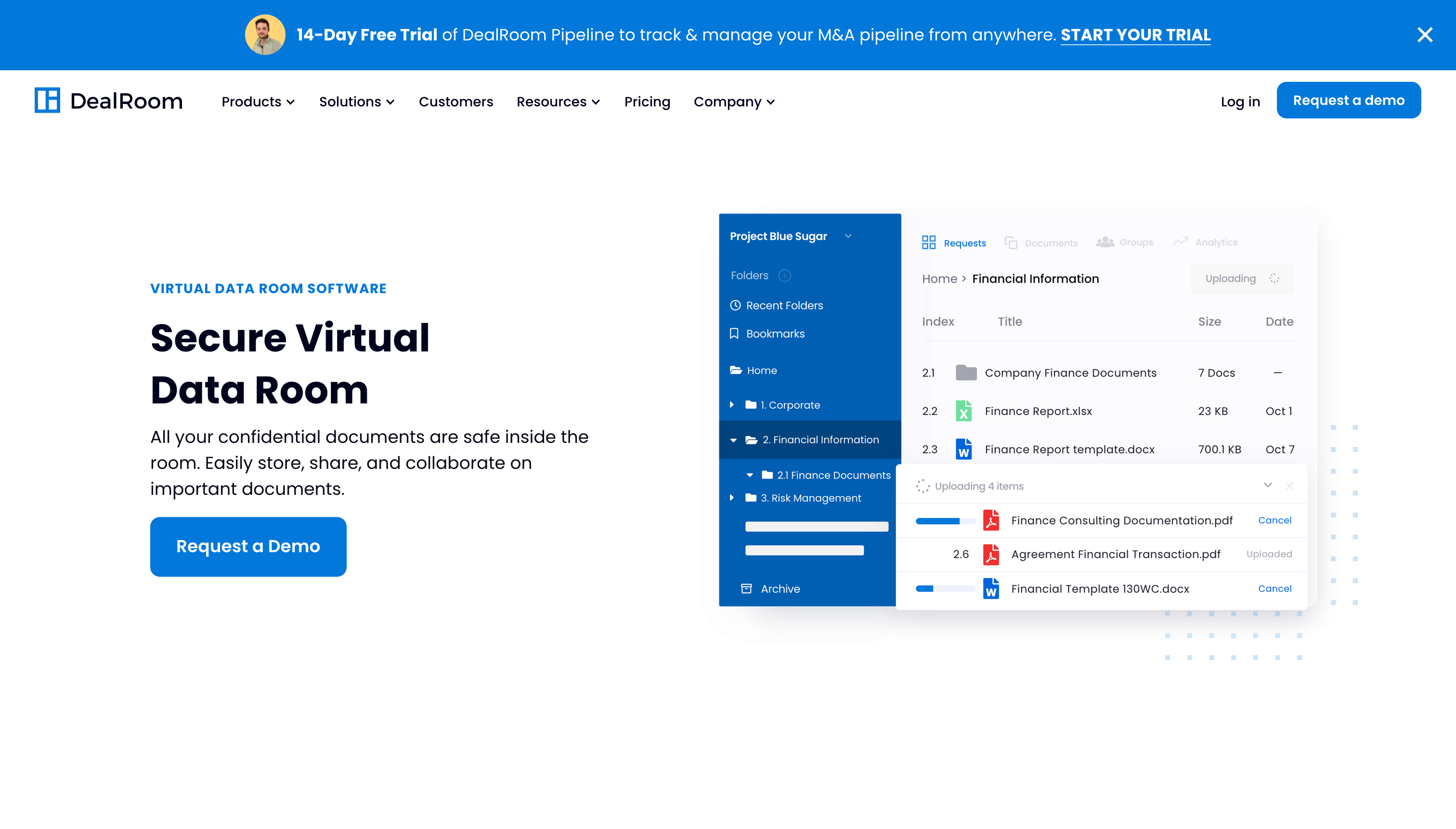

Everything you need for modern data room management

Dealroom Virtual Data Room

Modern virtual data room platform designed for M&A, due diligence, and complex transactions. Trusted by leading investment banks and law firms worldwide.

What is Dealroom VDR?

DealRoom is an M&A management platform by DealRoom Inc, an American software provider established in 2012 and headquartered in Chicago, Illinois, USA. DealRoom is an all-in-one business platform that helps companies raise funds, close M&A deals, and collaborate smarter and faster.

The company hasn't been acquired or rebranded. It is also featured on the M&A Science network, a podcast platform for dealmakers. DealRoom will suit a business of any size in the merger-and-acquisition stage as it streamlines respective processes.

The company offers a 14-day free trial – you can request it on the company website by reaching out to the customer support representative. Customers can also schedule a free 30-minute video demo of the platform features.

DealRoom is designed for M&A deals, post-merger integration, IPO, and due diligence. It features a full-fledged data room for secure document storage and exchange, with the document repository allowing you to upload files and folders in bulk using a drag-n-drop feature.

With Dealroom data room software, businesses can manage due diligence processes on a single platform without switching between data rooms, emails, or bulky Excel sheets. DealRoom offers diligence capabilities including request items, document redaction, and collaboration functionalities.

DealRoom allows you to manage as many deal projects as you need through the pipeline management dashboard – an audit of your projects and associated data rooms. The platform offers project metrics tracking and comprehensive project management capabilities.

DealRoom helps over 2,000 businesses worldwide. Many clients come from the United States, Canada, and Europe. They use DealRoom to close M&A deals, optimize post-merger integration, raise funds, and more. DealRoom's solutions help businesses of any size in the legal, government, energy, and other sectors.

DealRoom's website attracts over 140 thousand visitors – most of them come from South Africa (22.82%), the United States (18.93%), India (11.93%), and the United Kingdom (11.14%).

Advantages

Things To Consider

Software Details

Deployment

Support

Training

Free Trial

Free Demo

Global Rating

Platform Ratings

User Satisfaction

Customer Service

The quality of customer care is something Dealroom virtual data room is proud of. And rightly so, considering the feedback real clients leave on such reliable platforms as G2 and Capterra.

So what makes Dealroom's customer care so competitive?

Support Channels

- 24/7 customer support

- Dedicated account managers

- Comprehensive documentation

- Training and onboarding

- Multilingual support

- Priority support for enterprise clients

Response Times

- Email: Within 4 hours

- Phone: Within 2 hours

- Chat: Real-time

- Training: On-demand

- Account Management: Dedicated

Security Compliance and Certification

Security Features

- Bank-level encryption

- Multi-factor authentication

- Dynamic watermarks

- Granular access controls

- Comprehensive audit trails

Compliance

- SOC 2 Type II

- ISO 27001

- GDPR compliant

- HIPAA ready

- PCI DSS compliant

Competitive Advantages

User-Friendly Interface

Intuitive design and easy-to-use features that require minimal training

Cost-Effective Pricing

Competitive pricing that provides excellent value for money

Comprehensive Deal Management

Complete suite of tools for managing complex M&A and due diligence processes

Global Presence

Worldwide offices and support to serve international transactions

Features

Security & Hosting

Accessibility & Ease of Use

File Protection & User Management

Activity Tracking & Reporting

Collaboration Features

Customization

Use Cases

What Areas is Dealroom Best For?

DealRoom VDR is the best solution for M&A deals and associated processes like due diligence, audits, group collaboration, etc. You can also repurpose the VDR functionalities for IPO, divestment, bankruptcy and restructuring, and more.

DealRoom customers use the platform to share files, collaborate with investors, prepare legal documents, conduct business audits, and more.

Assuming rich data management functionalities, DealRoom will suit many industries, including but not limited to finance, government, healthcare, corporate, and energy.

Top Clients

DealRoom helps over 2,000 businesses worldwide. Many clients come from the United States, Canada, and Europe. They use DealRoom to close M&A deals, optimize post-merger integration, raise funds, and more. DealRoom's solutions help businesses of any size in the legal, government, energy, and other sectors.

DealRoom helped these prominent companies and organizations in the following industries:

Pricing

DealRoom provider offers three pricing solutions: Single Room, Professional, and Enterprise. Users have the option of paying monthly or annually. Monthly prices start at $1,250 for the Single Room plan and $3,000 for the Professional plan. Contact DealRoom to request a custom quote for their Enterprise plan.

The price of the DealRoom VDR software is on the medium-high side as compared to other providers in the same category. Most users point out that the prices are more cost-effective for long-term projects. The two-week free version allows customers to test the product.

Single

Use for Small size business needs

- • 5GB data storage

- • Project Management Features

- • Data Room Features

Professional

Use for Middle size business needs

- • 20GB data storage

- • Project Management Features

- • Data Room Features

- • Customize logo and colors

- • Custom reporting

Enterprise

Use for Large size business needs

- • 50GB–1TB data storage

- • Project Management Features

- • Data Room Features

- • Customize logo and colors

- • Custom reporting

- • Private Instance

Integrations & Workflow Templates

DealRoom offers extensive integration capabilities with popular business tools and pre-built workflow templates designed to streamline M&A processes, due diligence, and post-merger integration activities.

Native Integrations

- Slack (real-time notifications)

- Salesforce CRM

- Microsoft Teams

- Google products (Drive, Docs)

- API for custom integrations

Pre-Built Workflow Templates

- Due diligence checklist templates

- Post-merger integration (PMI) templates

- IPO preparation workflows

- M&A transaction templates

- Customizable request tracking

API Capabilities

DealRoom provides REST API support for transferring files from internal project management tools and automating workflows. The API enables custom integrations with existing enterprise systems.

Getting Started with DealRoom

DealRoom makes it easy to get started with their M&A platform through comprehensive onboarding support and flexible trial options.

14-Day Free Trial

Full access to platform features with no credit card required

30-Minute Demo

Schedule a personalized video demonstration of key features

24/7 Support

Email and chat support available around the clock

Onboarding Process

Request Trial or Demo

Contact DealRoom to start your 14-day trial or schedule a demo

Platform Setup

Configure your data room, upload documents, and set permissions

Team Invitation

Invite team members and external parties with appropriate access levels

Workflow Selection

Choose from pre-built templates or create custom workflows

Go Live

Launch your project with ongoing support from DealRoom team

Compliance Certificates

DealRoom complies with the following standards:

Frequently Asked Questions

What is DealRoom?

+

DealRoom is an M&A management platform that combines virtual data room and business collaboration tools. It's designed for M&A deals, post-merger integration, IPO, and due diligence processes.

What are DealRoom pricing plans?

+

DealRoom charges a flat monthly fee, but you can choose an annual plan, which is 20% cheaper. The basic plan costs $1,250 per month or $1,000 per month if billed annually. The pricing for cross-functional and enterprise plans is quote-based and can be provided upon request.

What makes DealRoom different from other VDR providers?

+

DealRoom stands out with its user-friendly interface, comprehensive deal management tools, and cost-effective pricing. The platform offers high connection speed during bulk uploads and downloads, the ability to track individual requests, and informative system notifications.

Is DealRoom suitable for small businesses?

+

DealRoom is designed for businesses of any size in the merger-and-acquisition stage. While it offers comprehensive features, the pricing may be more suitable for medium to large businesses due to the starting price of $1,250/month.

What security features does DealRoom offer?

+

DealRoom provides comprehensive security including two-factor authentication, access expiration, IP-based access limitation, ISO/IEC 27001:2013 certification, SOC 1 certification, GDPR compliance, HIPAA compliance, 99.9% uptime guarantee, and 256-bit SSL/TLS encryption.

Does DealRoom offer a free trial?

+

Yes, DealRoom offers a 14-day free trial that you can request on the company website by reaching out to the customer support representative. Customers can also schedule a free 30-minute video demo of the platform features.